capital gains tax proposal effective date

Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that.

Morningstar Moments 3 Things You May Have Missed Morningstar

The effective date for most of the proposals is Jan.

. Which leads to the oft-asked question of when. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. The effective date for the proposal would be the date of enactment.

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

More than five months ago. If this were to. These remain options and Democrats have discussed whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is.

The Green Book says this. In that the Green Book calls for an effective date. This proposal would be effective for.

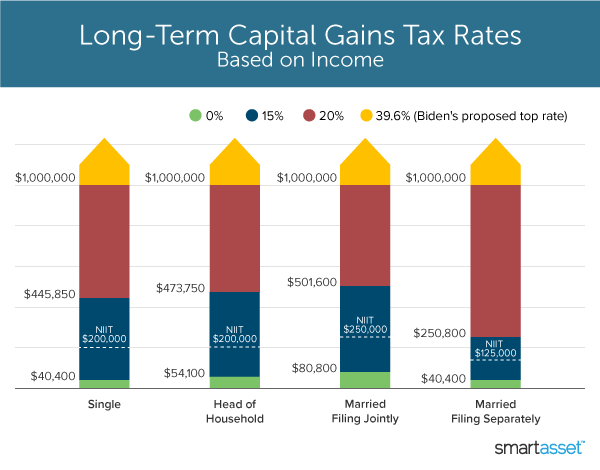

Individual Income Tax Rate The proposal would be effective for taxable years beginning after December 31 2022. Limit the maximum 199A qualified business income deduction to 500000 in the case of a joint return 400000 for an individual return 250000 for a married individual filing. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on.

President Biden has proposed a substan tial increase in the capital gains rate. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Dems eye pre-emptive capital gains effective date.

In short we dont yet know the answer to this important question. Minimum Tax Liability The administration also proposes a minimum tax of. In the Presidents budget plan released on May 28th Biden proposed making the increased long-term capital gains tax rate effective retroactively to April 28 2021 in order to.

The effective date for most of the proposals is Jan. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced.

The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April. The House bill would apply the increase.

Tax policy wonks suggest the revenue-maximizing capital gains tax rate and negotiations could land around 25 to 30.

Tax Cuts Jobs Act Tcja H R Block

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report Marketwatch

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

House Ways And Means Committee Tax Proposal

Qualified Small Business Stock Considerations For 100 Gain Exclusion

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

The Corporate Minimum Tax Could Hit These Ultra Profitable Companies The Washington Post

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

Capital Gains Tax In The United States Wikipedia

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

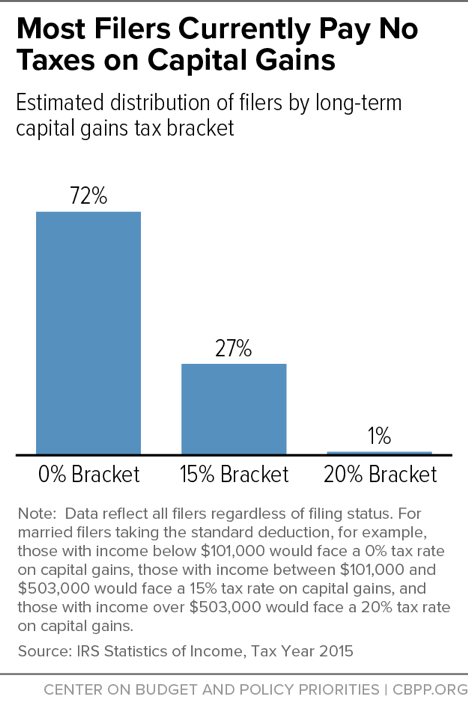

Indexing Capital Gains For Inflation Would Worsen Fiscal Challenges Give Another Tax Cut To The Top Center On Budget And Policy Priorities