oregon workers benefit fund tax rate

10 2021 142 PM. Employers use Forms OQ and OTC to report and pay the assessment through Oregons Combined Payroll Tax Reporting System.

Pin On Legalshield Independent Associate

The state transit tax.

. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under workers comp. The Oregon statewide transit tax rate remains at 01 in 2022. The Workers Benefit Fund WBF assessment this is a payroll assessment calculated on the basis of hours worked by all paid workers owners and officers covered by workers compensation insurance in Oregon and by all workers subject to Oregons Workers Compensation Laws whether or not covered by workers.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die from workplace injuries or diseases. For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022.

Additionally an employers UI tax experience rating for 2022 through 2024 will roll back to the pre-pandemic 2020 UI experience rate benefit ratio. Your tax rates may fluctuate during the 2022 2024 period due to tax schedule changes. Employers and workers each pay half of the assessment.

The pure premium rate decrease is effective January 1 2020 but employers will see the changes when they renew their policies in 2020. The WBF assessment rate. 2021 UI Tax Relief fact.

Ombuds Office for Oregon Workers 800-927-1271. For information about calculating the assessment visit oregongovDCBSPages. 22 cents per hour worked.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour. Oregon Workers Benefit Fund Payroll Tax Overview.

2 you choose to provide workers. Workers Benefit Fund Payroll assessment Special benefits for certain injured workers and their families and return-to-work programs. The 22 cents-per-hour rate is the employer and worker rate combined.

Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax. Employers and employees split this assessment. Employers and employees split the cost.

Oregon Workers Benefit Fund. By Jazlyn Williams. Workers Benefit Fund assessment.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. The benefit fund assessment pays for return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die.

These programs help keep Oregons workers compensation costs low. UI Trust Fund fact sheet. Employers are required to pay at least 11 cents per hour.

The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation insurance in Oregon and by all workers subject to Oregons Workers Compensation Laws whether or not covered by workers compensation insurance. Workers Benefit Fund WBF Assessment Definition. Tax Formula Set Up.

Go online at httpswww. General Oregon payroll tax rate information. Workers compensation rate information.

This assessment would decrease to 22 cents per hour worked for 2020 down from 24 cents per hour for 2019. You are responsible for any necessary changes to this rate. You are required to report and pay the WBF assessment if 1 you have workers for whom you are required by Oregon law to provide workers compensation insurance coverage.

The workers benefit fund assessment rate is to be 22 cents per hour in 2022. Employers contribute not less than half of the hourly assessment 11 cents per hour and deduct not. The purpose of the tax is to help fund programs in Oregon to help injured workers and their families.

The assessment is paid directly to Oregons Employment and Revenue departments through quarterly payroll tax reports and the revenue is transferred. The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation. The funds revenue comes from a cents-per-hour-worked assessment.

16 at 3 pm. Virtual public hearing set for Thursday Sept. The rate is unchanged from 2021.

The Oregon workers compensation payroll assessment rate is not to change in 2022 the state Department of Consumer and Business Services said Sept. This tax rate is the same for all. Wwwdcbsoregongov Testimony of DCBS Director Our Mission.

Employers and employees split the cost evenly. To protect and serve Oregons consumers and workers while supporting a positive business climate Workers Benefit Fund Assessment Rate Andrew Stolfi September 16 2021 The Workers Benefit Fund WBF assessment provides benefit increases to permanently disabled. These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers.

2021 Tax Rates and breakdown of changes for Oregon employers. However the rate will be based on your experience rate prior to the pandemic. The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and assessments down from 111 for 2019.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to. It is automatically added by payroll but requires a manual entry of the workers assessment rate for each employee and company rate.

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

At The End Of The Day How Much Does An Employee Cost Hourly Inc

![]()

Oregon Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Permanent Disability Benefits Worksafebc

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Future Of Work Initiative State Policy Agenda The Aspen Institute

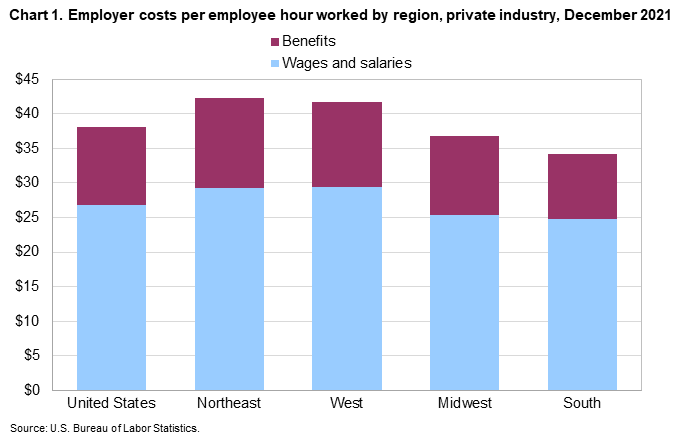

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

Short Term Disability Ultimate Guide 2021 Resolute Legal Disability Lawyers

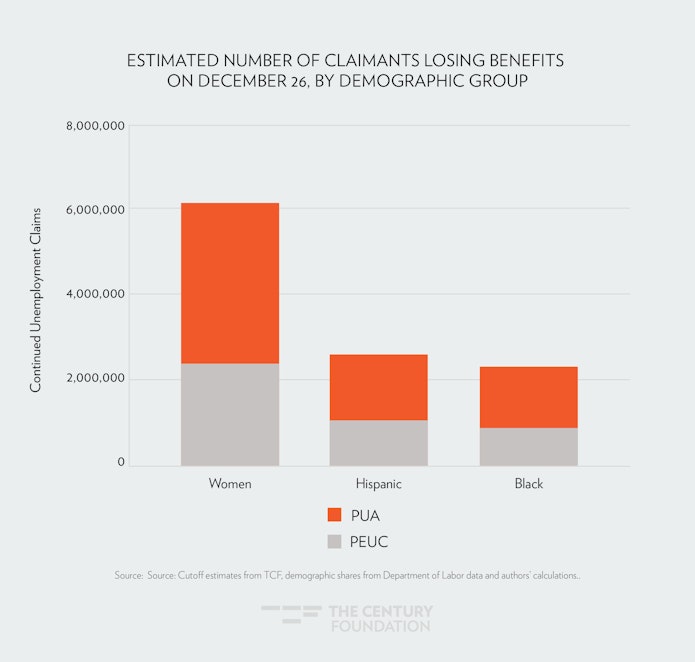

Looming Unemployment Cliff Will Hit Women And People Of Color The Hardest

Oregon Workers Benefit Fund Wbf Assessment

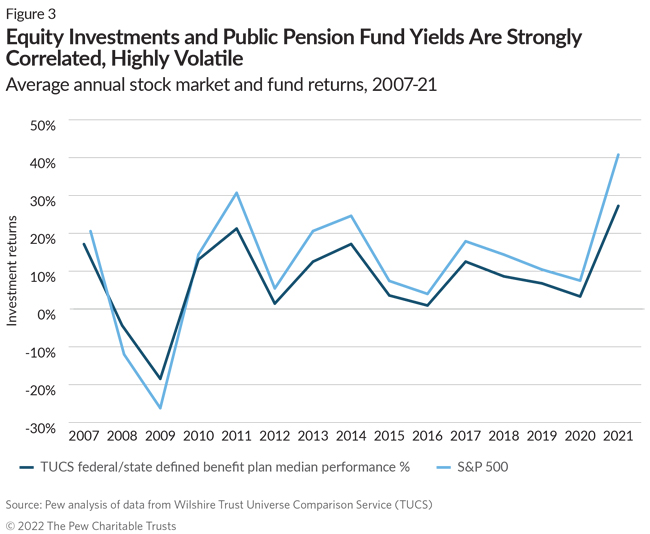

State Public Pension Fund Returns Expected To Decline The Pew Charitable Trusts

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

Permanent Disability Benefits Worksafebc

Employers Sweeten Child Care Benefits To Win Over Workers

5 Employee Benefits You Are Legally Required To Provide